by Kaye Ridolfi, Senior Vice President, Advancement and Ginger F. Mlakar, General Counsel & Senior Director, Donor Relations, Cleveland Foundation

Baby boomers are reported to have the largest retirement savings of any American generation, and IRAs – or Individual Retirement Accounts – are one of the most common retirement savings vehicles. These taxwise tools come in many forms and grow either tax-free or tax-deferred. Whether Traditional, Roth, Simple or SEP, IRAs are also inheritable assets that owners can leave behind to their spouses, children and other beneficiaries.

The SECURE Act, which became law at the end of December, includes major implications for affluent retirees with IRAs in their estate. Chief among these developments is the requirement that beneficiaries, other than spouses and other limited groups identified by the law, must spend the full balance of their inherited IRA within 10 years. This effectively ends the “Stretch IRA” for many as a strategy whereby beneficiaries would stretch out the required minimum distribution (RMD) over their lifetimes – minimizing how much is counted as income, the upward pressure on a person’s income tax bracket and the overall amount paid in income taxes. With the new law’s required 10-year payout, financial planning professionals are projecting that roughly a third of an IRA’s value may be payable to the IRS. Still, strategies remain for those who were hoping to leave more of their IRA to children and other heirs, such as utilizing the charitable remainder trust.

Charitable Remainder Trust

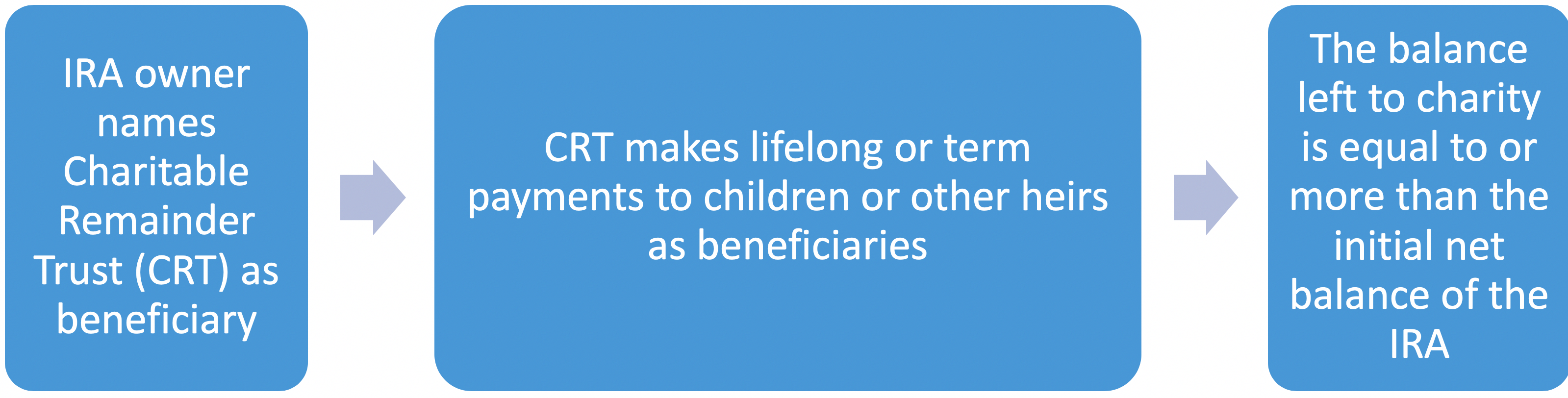

A charitable remainder trust (CRT) can be established with an organization like the Cleveland Foundation and offers an immediate upfront income tax deduction while providing ongoing income to its beneficiaries. These trusts come in two flavors: the charitable remainder unitrust (CRUT) and the charitable remainder annuity trust (CRAT). Payments from a unitrust are based on a percentage (at least 5% or more) of the trust assets valued annually, and payments from an annuity trust are a fixed sum based on the initial value of the trust. In either case, at maturity, which is either life or a term of years, the remainder of the trust assets are designated for charity. This tool is fondly called a “give it twice trust” as illustrated below. If an IRA owner names a CRT as its beneficiary, then it is possible to effectively bring back the stretch across the CRT’s beneficiaries’ lifetimes. It’s important to note that the CRT is tax exempt, so no income taxes are paid when the IRA assets are added to it. In certain cases, CRT income to the beneficiaries may also be counted as capital gains, which is taxed at a lower rate than ordinary income.

The “Give It Twice Trust”

|

|

Direct to Children or Other Heirs |

5% CRT Named as Beneficiary |

|

Transfer from IRA |

$2,000,000 |

$2,000,000 |

|

Federal income tax (est. 22% bracket) |

$440,000 |

$0 |

|

Net outright to children or other heirs |

$1,560,000 |

$0 |

|

Total income payments from CRT (est.) |

$0 |

$3,442,647 |

|

Total benefit to children or heirs (est.) |

$1,560,000 |

$2,069,634 |

|

Total benefit to charity (est.) |

$0 |

$4,065,588 |

|

Total benefit to children and charity (est.) |

$1,560,000 |

$3,655,707 |

Other Changes

Generally, the SECURE Act was intended to make it easier for more Americans to save for retirement by removing some barriers that prevented employers and individuals from previously accessing these plans. The legislation also:

- increased the age at which account holders must begin taking the annual RMD from 70 ½ to 72 years old.

- eliminated the maximum age for contributions – account holders can continue to add to their IRA even as they take the RMD.

Charitable IRA Rollovers

The SECURE Act still allows individuals to make Qualified Charitable Distributions (QCDs) up to $100,000 a year beginning at age 70 ½. (It remains to be seen if Congress will adjust this age to 72 in alignment with the RMD change.) This is called a Charitable IRA Rollover and remains an effective philanthropic, estate planning and tax strategy. QCDs count toward fulfilling the RMD but do not count as income for tax purposes. Continuing with an annual Charitable IRA Rollover would allow the account holder to strategically reduce the value of this taxable asset before passing it to heirs.

The Role of Donor Advised Funds

Another strategy for beneficiaries facing the 10-year draw-down could be to withdraw, annually for nine years, just under the amount that would elevate them to the next tax bracket and then withdraw the balance in year 10. Assuming this is the largest withdrawal, the child or other heir could also make a sizable charitable gift in the same tax year, such as setting up a donor advised fund (DAF) or other instrument that allows an income tax deduction, which would help offset the tax impact of the withdrawal. While DAFs are not eligible to receive QCDs, they are a fantastic tool for ongoing charitable deductions and provide grantmaking joy for years to come. Contributions to a DAF, and the tax write-off that comes with it, could also help an IRA beneficiary better target his or her tax bracket throughout the 10 years.

Kaye Ridolfi, Senior Vice President, Advancement

Ginger Mlakar, General Counsel & Senior Director, Donor Relations

It’s recommended that those passing on significant IRA assets to children or other heirs should contact their tax or financial planning professional for a consultation regarding the SECURE Act. We stand ready to help assist professional advisors and their clients with a philanthropic strategy in light of this new law and continue to provide a number of charitable vehicles for retirement, estate and tax planning. Please contact us via our Advancement hotline at 877-554-5054 and kRidolfi@clevefdn.org and gMlakar@clevefdn.org for further information.